ETH Price Prediction: Analyzing Technical and Fundamental Drivers Through 2040

#ETH

- Technical Foundation: Current price action below key moving averages suggests short-term consolidation with Bollinger Band support at $3,942 providing a critical level

- Institutional Activity: Major wallet movements indicate significant accumulation despite retail nervousness, creating a divergence in market participation

- Long-term Catalysts: ETF developments, scaling solutions, and enterprise adoption represent fundamental drivers that could propel ETH toward higher valuations over multi-year timeframes

ETH Price Prediction

Technical Analysis: ETH Shows Mixed Signals Below Key Moving Average

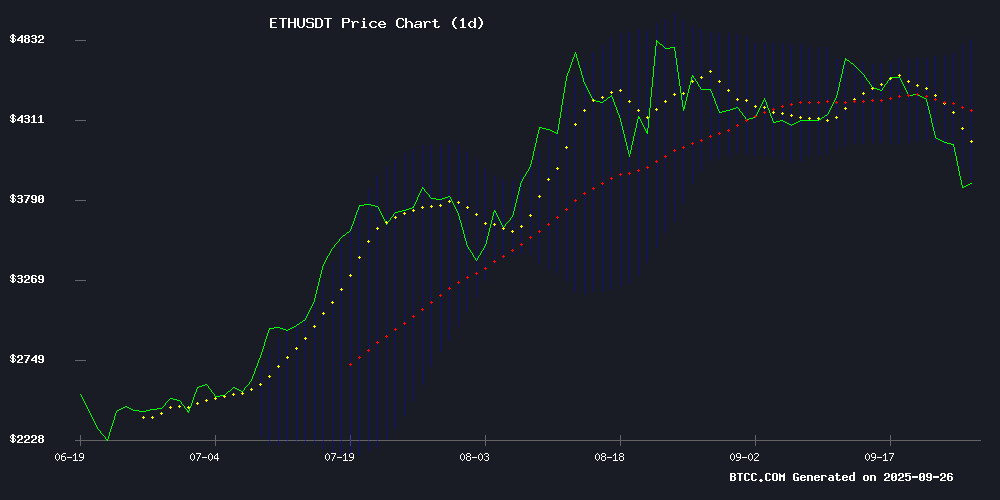

Ethereum is currently trading at $3,962.35, significantly below its 20-day moving average of $4,383.20, indicating short-term bearish pressure. The MACD indicator shows a positive histogram at 99.32, suggesting some bullish momentum despite recent declines. However, ETH is trading NEAR the lower Bollinger Band at $3,942.41, which may act as support. According to BTCC financial analyst Sophia, 'The technical picture suggests consolidation around current levels with potential for a rebound if the lower Bollinger Band holds as support.'

Market Sentiment: Institutional Accumulation Contrasts with Retail Concerns

Recent market developments show contrasting signals for Ethereum. While significant institutional wallets have received nearly 300,000 ETH worth $1.19 billion, indicating potential accumulation, retail confidence has been eroded by scams and price volatility. BTCC financial analyst Sophia notes, 'The divergence between institutional accumulation and retail nervousness creates a complex sentiment landscape. The launch of new staking ETFs and major tokenization partnerships provide fundamental support despite short-term price pressures.'

Factors Influencing ETH's Price

VC Challenges Tom Lee's $60K Ethereum Projection Amid Fee Stagnation

Andrew Kang, partner at Mechanism Capital, has dismissed Fundstrat CIO Tom Lee's bullish $60K ethereum price target as unrealistic. Kang's critique centers on Ethereum's stagnant transaction fees despite the 1000x growth in tokenized markets since 2020. "Fees are practically at 2020 levels," Kang noted, arguing that value accrual mechanisms don't support Lee's tokenization thesis.

The debate highlights Ethereum's current consolidation between $1K-$4K, with Kang emphasizing that institutional adoption remains elusive. Banks show no inclination to hold ETH as a treasury asset, contrary to Lee's expectations. Ethereum's realized price at $2.8K now serves as a critical support level for accumulation addresses.

Ethereum Whales Retreat as Sharks Accumulate Amid Market Pullback

Ethereum's price slide toward $4,100 coincides with a striking exodus of major investors. Blockchain analytics reveal a sustained decline in whale holdings—addresses historically controlling vast ETH reserves are rapidly reducing exposure. This redistribution of ownership is reshaping market dynamics.

While whale dominance wanes, a new class of mid-tier investors is filling the void. So-called 'sharks'—holders of 10,000 to 100,000 ETH—are aggressively accumulating during the downturn. Their growing market share suggests a calculated bet on Ethereum's long-term viability despite short-term bearish sentiment.

The shift mirrors broader crypto market anxieties, yet presents a paradox. Whale departures typically signal caution, but simultaneous accumulation by strategic players indicates layered market psychology. As liquidity changes hands, Ethereum's next price movement may hinge on whether sharks emulate whales' exit or maintain their accumulating stance.

Ethereum Price Drop Below $4K Worry Traders, Why Is ETH Crashing?

Ethereum's price has plunged below the $4,000 mark, shedding 8% in a single day. The sudden drop has rattled traders, prompting questions about the underlying causes of the sell-off.

Market sentiment appears to be shifting as ETH struggles to maintain key support levels. The broader crypto market often moves in tandem, but Ethereum's sharper decline suggests asset-specific pressures may be at play.

Ethereum On-Chain Bloodbath: Rugs And Scams Erode Retail Confidence

Ethereum's on-chain ecosystem faces a crisis of confidence as a surge in scams and rug pulls rattles retail investors. Despite the blockchain's underlying robustness, deceptive projects are draining trust and capital. The Book of ethereum (BOOE) emerges as a rare ethical standout—shunning paid influencers, cultivating organic community growth, and demonstrating team integrity amid widespread greed.

Analyst Fat Tony's public critique highlights Ethereum's paradoxical state: a breeding ground for both innovation and exploitation. BOOE's grassroots success story underscores what the network could achieve if malicious actors were purged. The tension between Ethereum's DeFi leadership and its deteriorating reputation now threatens to stall broader adoption.

Ethereum Dips Below $4K Amid Heavy Liquidations as REX-Osprey Launches Staking ETF

Ethereum's price slid below the $4,000 threshold for the second time in five days, triggering over $400 million in futures liquidations. The downturn reflects broader bearish sentiment across crypto markets, with negative funding rates signaling trader caution.

REX Shares and Osprey Funds seized the moment to launch the first U.S. Ethereum staking ETF. The REX-Osprey ETH + Staking ETF (ESK) tracks ETH's spot price while distributing monthly staking rewards directly to investors—a structural advantage over conventional spot ETFs.

Technical analysts note ETH may find support at the 100-day SMA after losing critical price footing. The dual narrative of market turbulence and institutional product innovation creates a pivotal moment for Ethereum's ecosystem.

11 Wallets Receive 295,861 Ethereum ($1.19B) From Major Institutions: Accumulation Or OTC Shuffle?

Ethereum struggles to hold the $4,000 level after an 11% drop since Monday, signaling a shift in market sentiment. Bulls have lost momentum, and sellers are capitalizing on the downturn. This correction follows weeks of upward pressure that pushed ETH toward multi-month highs.

Analysts remain divided. Some view the pullback as a healthy consolidation, arguing Ethereum is digesting gains before another rally. The $4,000 mark now serves as a critical psychological and technical battleground.

Lookonchain reports unusual activity: 11 wallets received 295,861 ETH ($1.19B) from institutions like Kraken, Galaxy Digital OTC, BitGo, and FalconX. Speculation swirls around whether this signals accumulation or ETF-related demand.

SharpLink Gaming to Tokenize SBET Stock on Ethereum via Superstate Partnership

SharpLink Gaming (SBET) is making a bold MOVE into blockchain by tokenizing its SEC-registered common stock on Ethereum. The company, one of the largest corporate holders of ETH, will leverage Superstate's Opening Bell platform—a first for a public company. Despite an 8% share price drop on announcement day, the initiative signals SharpLink's conviction in Ethereum as the infrastructure for next-gen capital markets.

Superstate CEO Robert Leshner framed the partnership as a milestone for Ethereum-aligned enterprises. The collaboration aims to demonstrate how public companies can use blockchain to enhance shareholder value and redefine market infrastructure. SharpLink's treasury strategy—holding substantial ETH reserves—now extends to pioneering tokenized equity issuance.

Ethereum Plunges Below $4,000 Amid Massive Liquidations, Signaling Market Cooling

Ethereum's price tumbled below the critical $4,000 support level, triggering a cascade of Leveraged long position liquidations totaling $329 million within 24 hours. The sudden drop reflects growing investor unease as macroeconomic headwinds and slowing institutional demand weigh on crypto markets.

Whale activity underscored the severity of the selloff, with one address (Oxa523) losing $45 million on a 9,152 ETH position. Market analysts attribute the volatility to reduced ETF inflows and declining trading volumes, suggesting the September rally may be losing steam.

Merlijn The Trader's liquidation alert highlights the perils of excessive leverage during periods of heightened volatility. The event marks Ethereum's sharpest correction since its recent climb toward yearly highs.

Ethereum Price Prediction: $10,000 Target by 2026 Hinges on Three Key Catalysts

Ethereum's price trajectory suggests a potential surge beyond $10,000 by 2026, contingent on three critical factors: scaling upgrades, institutional adoption, and supply dynamics. Analysts highlight the $5,000-$6,500 resistance zone as the first major hurdle.

Exchange reserves for ETH have dwindled to historic lows, with the exchange supply ratio hitting 0.139—a signal of tightening liquidity. The upcoming Fusaka upgrade in December 2025 could further catalyze gains by optimizing network efficiency.

Institutional interest looms large, with ETF inflows and corporate treasury allocations potentially accelerating demand. Meanwhile, projects like Payfi demonstrate how emerging altcoins are leveraging utility and incentives to carve niches alongside Ethereum's dominance.

Ethereum Accumulator Addresses See Massive Inflows Amid Market Pressure

Ethereum faces selling pressure as its price tests the $4,000 support level, but on-chain data reveals a counterintuitive trend. Despite the market downturn, accumulator addresses—wallets that only buy and never sell ETH—have absorbed nearly 400,000 ETH in a single day. This follows a record-breaking 1.2 million ETH inflow on September 18, signaling unwavering long-term conviction among institutional players.

Analyst Darkfost highlights these inflows as a critical undercurrent in Ethereum's market dynamics. Accumulator addresses, defined by their buy-only behavior, are increasingly seen as proxies for institutional adoption and ETF demand. The divergence between short-term price action and long-term accumulation suggests a strategic positioning by large holders, even as retail sentiment wavers.

Ethereum's $470M Liquidation Diverges from August's Market Dynamics

Ethereum's recent $467 million long liquidation event bears superficial resemblance to August's $444 million flush-out, but fundamental differences in market structure reveal opposing narratives. Where August's sell-off occurred in a buyer-dominated uptrend with positive funding rates, September's liquidation unfolded under bearish pressure with slightly negative funding.

Key metrics highlight the divergence: Open interest declined from $29 billion to $27.3 billion between events, while funding rates flipped from +0.013 to -0.0020. Technical positioning further distinguishes the scenarios—August's drop maintained support above critical EMAs and VWAPs, whereas September's action suggests weakening structural control.

The market now faces a critical juncture. August's leverage reset fueled continuation, but current conditions indicate shorts may be gaining influence. Traders are watching whether this liquidation marks a healthy correction or the early stages of trend reversal.

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and market developments, Ethereum's price trajectory shows potential for significant growth over the coming decades, though near-term volatility is expected.

| Year | Conservative Forecast | Moderate Forecast | Bullish Forecast | Key Drivers |

|---|---|---|---|---|

| 2025 | $4,500-$5,000 | $6,000-$7,000 | $8,000-$10,000 | ETF approvals, scaling solutions |

| 2030 | $12,000-$15,000 | $20,000-$25,000 | $30,000-$40,000 | Mass adoption, DeFi growth |

| 2035 | $25,000-$35,000 | $45,000-$60,000 | $75,000-$100,000 | Enterprise adoption, Web3 expansion |

| 2040 | $50,000-$75,000 | $100,000-$150,000 | $200,000-$300,000 | Global digital economy integration |

BTCC financial analyst Sophia emphasizes that 'These projections depend heavily on Ethereum's successful transition to full scalability and mainstream adoption. Current technical weakness below the 20-day MA suggests consolidation in the near term before potential upward movement.'